Here is a follow-up on the “Maybe Nikon won’t leave the market?” post from 2021 by RC Jenkins:

It’s time. 2 years ago, I blew the entire industry away by confidently and decisively declaring: “Maybe Nikon won’t exit the camera market?” 🤷🏽♂️

Clueless Youtubers looked puzzled as they requested “don’t forget to please like and subscribe?” Commenters scrambled to find the correct mind-blown gif. And everyone who worried about market share and thought Nikon was going to go bankrupt…continued to think that.

Well, well, well. How the tables have turned to Techno (…Systems Research) and to the melodic beatboxing of a custom Z9 shutter sound.

So here we are. And where’s that exactly? Let’s briefly catch up with some highlights since:

- Nikon launched the Z9 (and for only $5500), which had the highest first-year sales volumes of any flagship camera in 15 years. As Eamon Hickey pointed out, this is probably only among Nikon flagships, so since the D3 (Nikon’s first full-frame DSLR).

- Nikon got sued by Red for offering internal, Bayer-compressed raw video. Predictably, Red dropped the lawsuit and raw video stayed in Nikon’s cameras. At minimum, Nikon is currently ahead in offering internal raw video–even if competitors develop and offer this, there is a risk that Red will sue them. So they’ll have to hire expensive lawyers to copy-paste Nikon’s response, which Nikon’s expensive lawyers probably copy-pasted from Jinni Tech

- Nikon launched the Z8–essentially a de-gripped Z9–for only $4000. This is similar in price to the Canon R5, Sony A7RV, and Sony A9. And it’s also similar in specs to the Sony A1, which costs a full $2500 more.

- 80% of Nikon’s revenues now come from mirrorless cameras, similar to industry (CIPA). This is much higher than the ~20% Nikon estimated last time.

- Nikon Imaging just announced a record-high operating margin, at 18.6% of revenue. Nikons operating margin went from – ¥ 35.7B (FY2021) to + ¥ 42.2B (FY2023), an increase of ¥ 77.9B ($579M).

- Industry (CIPA) total ILC units have been steady, at ~5-6 Million units

- Nikon total ILC have been steady, at ~600-700K units

- Nikon Imaging’s sustained goal for the next few years is ¥ 200B, at ¥22B operating margin (at 10% of revenue)

Huh? Simple: from a business perspective, Nikon Imaging is healthy. As I said last time, unit market share isn’t everything: Nikon’s at ~12% for ILCs. But in Nikon’s case, operating profit is positive, in the hundreds of millions of dollars. They are making money. And money buys things–unit market share % does not.

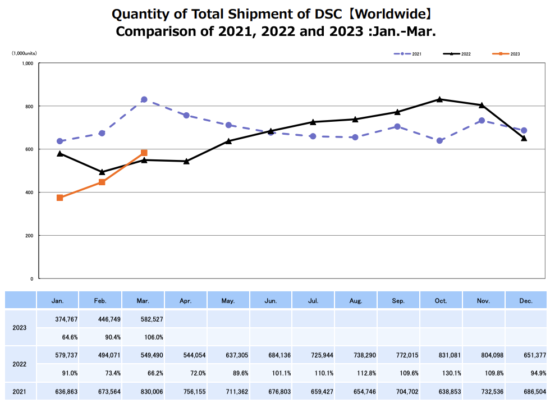

Speaking of the market, let’s take a look at the latest CIPA numbers too:

Oh, that’s a nice graph.

- 31% of all units are DSLRs; and 69% are mirrorless.

- DSLR units are continuing to decline, at around 20% per year.

- Mirrorless units seem to be steady, somewhere between 3-4M units annually

- Average DSLRs are entry-level at ~$375 wholesale, since 2011

- Average mirrorless are prosumer models at ~$950, rising from ~$300 in 2012

“But I demand that they supply me with a new DSLR. If they don’t offer new DSLRs, people won’t buy them!” Au contraire, mon frère. Look at DSLR trends when cameras like the D600, D750, D850, D500, D5, etc. were launched alongside 5DIII, 5DIV, 5DS, 5DSR (was that a different camera?), 6D, 7D, etc. DSLRs declined. And with the average values, we know that these cameras were always a drop in the bucket compared to the entry-level D3000’s and D5000’s and Kissing Rebels anyway. And not just for Nikon: Canon too. So if you really want a DSLR, expect a shiny new D3600 (or whatever number Nikon’s on now).

But don’t expect a new compact camera–Nikon seems to have stopped forecasting them. As I said last time: “Nobody really cares about compacts, but they somehow really confuse a lot of people because they show up in market share numbers.”

At that point, I transitioned to CIPA. And as so often happens, history repeats itself once again. So let’s relate Nikon to the industry per CIPA. Here’s how numbers can be deceiving until they undergo analysis: Nikon claims 80% of their revenue now comes from mirrorless cameras. We know CIPA average values for each: DSLR = $346, Mirrorless = $949; and we know Nikon sold 700K ILC’s. We can use these figures to convert into units. That would mean Nikon sold (roughly):

- 285K DSLRs (15% CIPA unit market share)

- 415K Mirrorless (10% CIPA unit market share)

- 700K total ILC (12% CIPA unit market share)

That’s still a lot of DSLR units (that will eventually go away); and that means 41% of their units are still DSLRs (and 59% mirrorless). So 80/20 revenue means 60/40 units (mirrorless/DSLR). But despite this, Nikon has also increased their unit market share of mirrorless cameras: from 7.5% a few years ago to 10%. Mirrorless camera units grew during this period; but an increase in unit share means Nikon was growing in mirrorless faster than others in the industry during this period. And yes, the 12% seems low; but remember, the industry is not homogenous. Nikon’s been small in everything except entry-level DSLRs for a long time. The difference is: now, all of that noise from entry-level DSLRs has been / is being cleared out; and Nikon’s successfully starting to grow in the pro/sumer space, specifically in mirrorless cameras.

But like last time: who cares about the units? WHAT ABOUT THE MONEY?

Nikon financial results for the year ended March 31, 2023: revenue up 28%, operating profit up 122%

Oh. If this trend continues, most DSLR consumers will be selling DSLRs to Nikon and Canon by 2024. And Larry will sell his to Pentax.

Let’s relate this back to Nikon. For ~2022, Nikon earned ¥ 222.1B, compared to CIPA’s ¥ 1119.0B. I don’t know if these are directly comparable; but if so, that’s a 20% market share in terms of revenue. If this is a valid comparison and Nikon’s market share is higher than their unit market share, then Nikon’s average camera sold is higher-end than the industry’s average camera sold. And when we also consider that CIPA’s average is now a prosumer mirrorless camera (and Nikon’s doing higher-end), we can conclude that Nikon’s Z6’s & above have been doing fairly well. And if we look at Nikon’s financial statements (I’m using calendar years instead of Nikon’s FY, so these will be a little off), we see the following average revenues across their imaging products (remember, cameras + lenses in this case):

- 2021 = $615

- 2022 = $861 (+40%)

- 2023 = $969 (+13%, forecasted)

So Nikon has indeed been focusing on selling higher-end products. Each average product that Nikon sells brings them around $900 today (and retail prices will be higher). And this has been growing.

And now that we know that Nikon’s average product has been higher than CIPA averages, and we know this might primarily be through mirrorless cameras, we can completely negate the earlier DSLR/mirrorless units breakdown for Nikon (where we used CIPA averages): we need to take a few units out of mirrorless and put a few more units into the DSLR category. I dunno, let’s just go with like:

- 300K DSLR (16% CIPA unit market share)

- 400K mirrorless (10% CIPA unit market share)

Does that look right? Sure. Whatever. It’s probably somewhere around there. The last few times we saw reliable figures from Techno Systems research, we learned that Nikon was doing around 250K mirrorless cameras per year for the first few years the Z cameras were offered. This is clear growth in mirrorless. And it’s probably sustainable on its own, though I think we’ll see Nikon surpass 500K mirrorless in the next few years.

So what’s next? I’ll keep it short & sweet.

Sony was the earliest brand to take mirrorless cameras seriously and push us into the full-frame realm, just like Canon really pushed for a lot of the DSLR autofocus and video technology. The next time you see anyone with a Canon or Sony camera, just quietly walk up behind that stranger, hug them, and tell them you love them for the sacrifices they made for you.

And tell them you are returning the favor. Because Nikon’s been pushing technology and prices in order to buy more into the market. Tell them you’ll give them raw video. Tell them you’ll give them cheaper prices. Tell them you’ll give them serious build quality and ergonomics. If they shy away, offer a trade: you’ll trade them maximum viewfinder resolution for a brighter, clearer, blackout-free viewfinder. Throw in Plane AF for free.

When they say “I thought you were dead!” Tell them that was just a rumor. But it was unreliable, because it wasn’t on NikonRumors.

If they ask you, “Why are you shooting with a gripped camera? What happened to your Z 7?” Tell them your 9 8 7.

6? Remember how awkward and uncomfortable it was when you came up and hugged a stranger from behind? Make sure you watch your 6. Because by the end of the year, you should have your face deep in a 6, squeezing it and clicking away. Just like Canon shooters do with their Rs.

Nikon’s going to be just fine, and they’re doing good things for us photographers/videographers. They’ve been aligning their offerings to industry demand–the equipment we buy. They’ve offered and opened up the door to internal raw video. They’ve consistently pushed performance-enhancing firmware updates (even if Z6ii / Z7ii owners think they didn’t get them, even though they did). They’ve created an entry point for vloggers, the new D3### users. And they’ve pushed the price-performance envelope by putting Canon’s R5 and Sony’s A1 and A7R on notice with the Z8 and Z9. Now, they just need to follow it up soon with some mid-range cameras. Especially a Z6III.

If Nikon keeps it up, maybe some consumers might even flow like the alphabet: from A to Z.

I’ll see you again in 2 years, when Nikon’s DSLR sales dwindle to almost nothing, their mirrorless unit market share has grown beyond 15%, their average revenue per unit is up 20%, they’ve demonstrated a few consecutive years of sustained revenue and profitability, and they’ve just released FW 2.3 for the Z6III to add crustacean AF…

…while everyone is still waiting for the 200-600 on the roadmap and FW 2.00 for the Z6ii/Z7ii.

Maybe? 🤷🏽♂️

–RC Jenkins, a formally educated, world renowned expert in all subjects & internet user.