“Maybe Nikon won’t exit the camera market” is by RC Jenkins:

There has been lots of talk lately on “market share.” Part of this is due to the recent article that identified Nikon has having 7.5% mirrorless market share in Japan, likely written by some journalist. Journalists are interesting in how uninteresting they are. They are usually masters in no particular field, except how to get people to read their articles and talk about them.

But the talk is on the internet, by the internet, which as I understand it is composed of an exclusive panel of formally educated world-renowned experts in all subjects. So somewhere out there, someone read that “the Canon M50 has 95% market share of APS-C mirrorless cameras where the model ends in 50”. And because they are an expert, they were able to validly extrapolate that “Canon has 95% camera market share!” And then everyone believes this, because this expert on the internet told them what to think, since the underlying facts are always obviously just noise. So here is a bit more internet to read, while you’re listening to Youtube videos play in 4K a few tabs over.

First, let’s talk relevant history during the era of Digital ILCs so far. What happened? Easy, peasy, McDeluxe:

- ~2000, we started seeing the first DSLRs. They were expensive. $thousands.

- ~2005, we started seeing cheap DSLRs. And social media became popular.

- ~2010, smartphones & social media were popular, but phones had poor cameras. Entry-level DSLRs surged, swelling the market. And we started seeing mirrorless cameras. Everyone thought they were a pro or wedding photographer because they had a DSLR.

- ~2015, phones had good cameras. And the entry market started to realize that an ILC has this thing called a “lens” that needs to be pretty big in order to see a difference in image quality on instagram. And phones faked it; and logically, they maked it.

- ~2020, entry level ILCs had plummeted, and the higher-levels shifted from DSLR to mirrorless. (Also, social media shifted from stills to video). Dedicated ILCs are now for serious photographers & videographers, no longer for the general public. Those D3500s collecting dust in everyone’s closets are S.O.L. because they don’t have a dust-off feature. But they don’t need it anyway because phones.

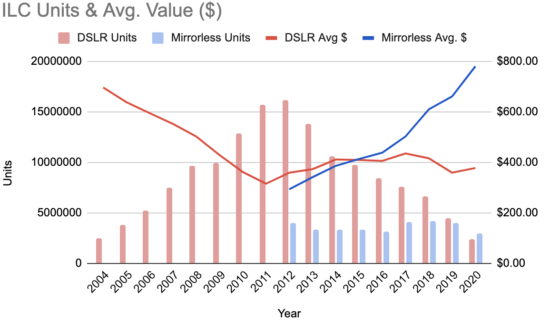

I’m ignoring compacts. Nobody really cares about compacts, but they somehow really confuse a lot of people because they show up in market share numbers. Market? CIPA time! (Note: from 2008-2011, CIPA probably called DSLR + Mirrorless = “DSLR”)

So:

- DSLRs rose rapidly from 2000-2010. At the same time, the average value plummeted.

This means “huge volumes of cheap DSLRs were sold.” The general public was buying them, because everyone was a Rebel; and plus, Ashton Kutcher told them to. - DSLR units declined rapidly from 2010-2020, while their average unit value stayed the same, at this depressed level (meaning heavily influenced by cheap high-volume DSLRs). This ratio is interesting. This means that the market was so saturated with cheap DSLRs that the enthusiast & pro was too tiny to make a dent in the numbers (see average value), or that DSLR users stopped buying DSLRs at the same proportion, regardless of level. Probably a bit of both.

- Mirrorless units have stayed pretty steady from 2010-2020. (No, mirrorless camera sales have not been rising). But their average value has risen dramatically, and their proportion of sales has risen because DSLR sales have dropped. So the same number of mirrorless cameras are being sold every year; and the cheap ones are making room for the higher-level ones.

- When these last 2 bullet points are merged, this likely means that entry level users are leaving the market altogether; and at the same time, higher-end DSLR users are leaving DSLRs & switching from DSLR to mirrorless. This wasn’t just a recent thing (Sony), though it accelerated a bit when Nikon & Canon entered full-frame mirrorless.

Duh. So…?

- It’s now a ~50/50 split on mirrorless vs. DSLR. But DSLR is trending as going away; and mirrorless units are trending as remaining relatively steady.

- Mid & high-end mirrorless is where it’s at. Same units as DSLR, but much more average unit value (and rising).

- We’re closer to the “bottom” sustainable level of the market. There’s still some room to fall (eg. DSLR disappearance, which won’t all translate to more mirrorless; and entry-level mirrorless), but the major stuff appears done. Volumes are pretty low and average values are increasing. I think the average mirrorless value will be a great indicator of when the market bottoms out. When it’s flat, the market will probably be stable.

And sooo that’s the market. What would a company within this market do? A company like Nikon?

- Focus on the mid- & high-end mirrorless market

- DSLRs are done. Sorry, they just are. They are the film cameras of digital cameras.

- Don’t expect much in terms of the entry-level. Maybe 1 camera every few years, if that, and not many lenses. We already have a Z50. I could see a higher-end DX mirrorless (a mirrorless D500) before a lower-end, unless Nikon wants to deliver one last uppercut to the entry market, like they tried with the Z5. But this would be a temporary surge at best, that might not be worth it.

- Nikon’s ILC market share will be interesting to watch. A few reasons:

- Nikon is 1 of only 2 major vendors who still sells DSLRs, and who still has a significant number of DSLR users.

- Canon, Sony, Fuji, Panasonic, & Olympus entry-level customers have been slowing down in buying entry-level mirrorless cameras.

- Market share is only part of the story, and historical market share in a declining market doesn’t actually tell anything about the health of the sustainable business. Whoops, this is a reason Nikon’s ILC market share will not be interesting to watch. Moving on…

So one question will be how much further (& faster) does Nikon have to drop for entry-level DSLRs, and how many DSLR users can they convert to Nikon Z, and how will the market look? Well…

Maybe we can try to figure this out. Or at least get a sense. According to Nikon’s investor sheets, they sold 900,000 ILC’s in 2020. According to CIPA, 2.4 million DSLRs were shipped last year, and 5.3 million ILC’s overall. This puts Nikon at a 17% ILC market share.

Separately, we heard that in 2020, per BCN, for some Japanese retailers, Nikon had a roughly 45% DSLR market share. This data might not be representative of the overall DSLR market. Maybe it’s 35% instead. Or even 25%. It’s probably not 50%. But let’s just pick a number and test its reliability, so assume 40% for our purposes.

So maybe (just maybe), these BCN numbers are not all that reliable as an indicator of market share. Maybe it’s because BCN is around 40% of retailers in Japan, which are mostly general department stores with a different type of average customer. Maybe.

But wait, didn’t we also recently see that Nikon has 7.5% mirrorless market share in Japan? Fine, let’s assume that’s similar to worldwide rate and see how that fits: 7.5% worldwide mirrorless market share in 2020 would translate to 220,000 Nikon mirrorless units. That means Nikon would have sold 680,000 DSLRs last year, for a DSLR market share of just 28%. Far off of the 45% BCN ranking. This would result in 24% of Nikon ILCs being mirrorless. They can’t both be true.

And for a 3rd data point, what do Nikon themselves say? They think they have 16% of the ILC market share. In late 2019 (slide #23), they also predicted that by the start of 2020, around 15% of their revenue would come from mirrorless; and linearly extrapolating this chart through 2020 would take it to around 20%. This is revenue, not units; and Nikon does still have the D3500 & D5600 selling (DSLRs) selling; and it was linear, not accelerating. So we can say “north of 20% of Nikon’s ILC units in 2020 would have been Nikon Z (and this could easily be 30% or more).

What we have here is several different limited views with plenty of fuzzy uncertainty. But the overlap & intersection of each view’s uncertainty can start to paint a clearer picture. This is pixel-shift stacking, but for numbers. For Nikon, it’s not all good; but it’s not all bad either. What can we conclude?

In 2020, Nikon would have sold somewhere in the vicinity of around 225,000 mirrorless Z cameras (7.5% mirrorless market share), and 675,000 DSLRs (28% DSLR market share). So only ⅓ of their overall ILC sales are mirrorless, compared to more than 50% of the market now being mirrorless. So even though it was for Japan, that recent article could have happened to also be representative regarding Nikon’s mirrorless market share worldwide (and remember that it ignores the DSLRs).

And Nikon would still have had 675,000 DSLR sales last year, which is pretty significant. That is 12% of the overall ILC market. That has to go somewhere. Some will disappear, some will change brands, and some will go Z. So let’s try to figure this out…

My guess is that each model level will have a different behavior. D3500 buyers might leave the market, while D750 users might switch DSLR for mirrorless. One method (though with limited reliability) will be to look at serial numbers to get a rough estimate of numbers by model. And let’s stick to “current” cameras. These could vary wildly from reality, but at minimum, we can roughly estimate proportions and then apply those to known quantities. So let’s take the serial numbers, try to estimate quantities, and then normalize these quantities for the duration each has been on the market (which will be less reliable for recent products). To be clear, this is the least reliable part of this article. This is probably less reliable than using BCN. But let’s just see what we get. We end up with:

- D3500 ~ 25%

- D5600 ~ 12%

- D7500 ~ 10%

- D500 ~ 11%

- D780 ~ 1%

- D850 ~ 12%

- D6 ~ 0%

- Z50 ~ 9%

- Z5 ~ 0%

- Z6 ~ 12%

- Z7 ~ 4%

- Z6II ~ 3%

- Z7II ~ 1%

Interestingly, this aggregates to:

- 71% DSLR

- 29% Mirrorless

Which is very close to our earlier estimate of ⅓ of Nikon ILC units being mirrorless. Even if the individual units of off, the aggregate seems to average out correctly.

Now, let’s carve these out a bit. If these assumptions are correct, then the Nikon D3500 & D5600 would account for around 37% of Nikon’s ILC units and 15% of revenue. Just to understand range, adding in the Z50 takes this to 45% and 20%, respectively. Sounds about in line with Nikon’s 2019 forecasts for revenue split between entry-level & pro/hobbyist.

We can also validate via expected revenues, by multiplying the market prices of those cameras by those expected proportions. And what we end up with is ~64% DSLR, 36% mirrorless. Plausible.

So I’d guess that this gives us a good sense of roughly Nikon can conceivably still lose. If half of the remaining entry market will still leave before things stabilize, Nikon will lose somewhere around 200,000 units and 10% of their revenue. They won’t necessarily lose these to other brands–these are people that will exit the market entirely (and conceivably, other brands will also continue to lose the entry level).

I think this also means that somewhere around 600k – 700k ILC units represents Nikon’s sustainable size, which is around 25% fewer cameras than they are forecasting for the current fiscal year. Who knows, might even be less.

Translating this to market share will depend on how much something similar happens to Canon (DSLR switch + entry-level drop), Sony (entry level drop), and the rest. But with the current market size, Nikon would end up between 10-15% of the ILC market with all else equal. But I don’t think all else will be equal. Other brands will lose some entry too, and the market will shrink some more. So I think this would be the ILC market share “floor” for Nikon; and that Nikon’s market share could be above this if other brands also lose some entry level.

So overall, I don’t think this implies Nikon is (or would) exit the market. It appears Nikon would be selling around 650,000 units at a much higher per unit revenue than previously, regardless of market size. By “much higher,” my guess is roughly 2-3x their previous unit revenues. So this 650k units will be pulling in as much revenue as around 1.5 million lower-end ILCs, like they had around 2018. Except now, they should have much lower operational costs (and likely other costs) compared to previously.

That is of course assuming they cater to the right crowd. And I think most of this would need to be somewhere between the Z6 and D850 levels, which is where I’d guess we’d see the most action and interest. These strike an optimal balance between volume & revenue…and probably margin as well. Yes, there will be a halo product to build the brand perception and get pros using the cameras, and yes, there will be 1-2 lower-end products to help entry, and yes, there will be a few extra products on either side. But it now seems that unlike the past decade, the new bread and butter will no longer be the entry-level DX cameras. That wave has crashed.

Nikon already has some pretty solid offerings here; but when they really improve things significantly (as I would expect them to by the 3rd generation Z’s), they’ll solidify their footing. Remember Nikon’s last round of 3rd generation products (respectively)? D750? D5? D850? Of course, everyone always has killer 3rd generation products. But interestingly, Sony’s 3rd gen has passed, and Nikon’s & Canon’s are just starting. I’m not saying that Sony will lose out. I’m just saying that most people who wanted to switch to Sony probably did so by the A7III & A7RIII; and I can’t foresee a mass exodus to them at this point (even with the $6500 a1). Instead, the 3rd generation Nikon Z’s & Canon R’s will be the generation that solidifies a user base in each system, and then those people will basically stick to those systems forever until something crazy happens.

So the numbers tell me that for Nikon, we’ll probably be seeing around half-a-million units annually, spread across:

- Flagship Nikon mirrorless (yes, it’s easy to “predict” after Nikon confirms stuff)

- Significantly improved Z6 (III) & Z7 (III), maybe 2022-2023

- A mirrorless D500?

- Few (if any) entry-level mirrorless cameras.

- No new DSLRs

- A bunch of mid- and high- end Z lenses, with a few entry lenses sprinkled in here & there

Anything else is a cherry on top. And this alone will be enough for Nikon to maintain a solid, sustainable foothold in the market. Not #1 and not exiting the market. In real life, there is a lot between those two scenarios; but on the internet, that spectrum might be too complicated to work. I heard the internet is binary.

–RC Jenkins, a formally educated, world renowned expert in all subjects & internet user

Another SPECULATION that Nikon will exit the camera business (CLICKBAIT ALERT)