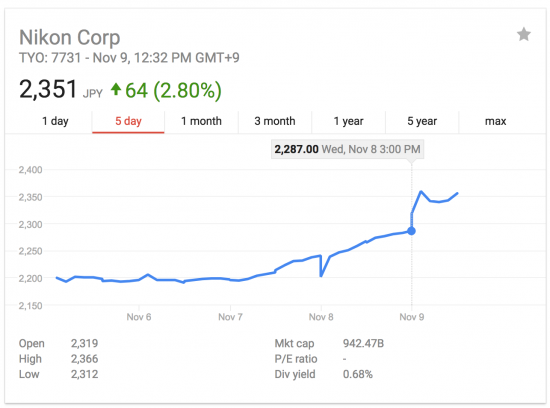

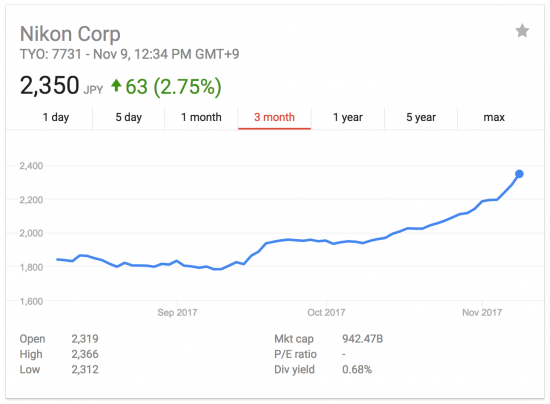

Just a quick update: Nikon’s stock is up since they announced their Q2 financial results two days ago. Here is the last 5 days chart (for comparison the last time they reported bad news in February 2017, the stock went down 15% – it hit 1300, now it’s at 2350):