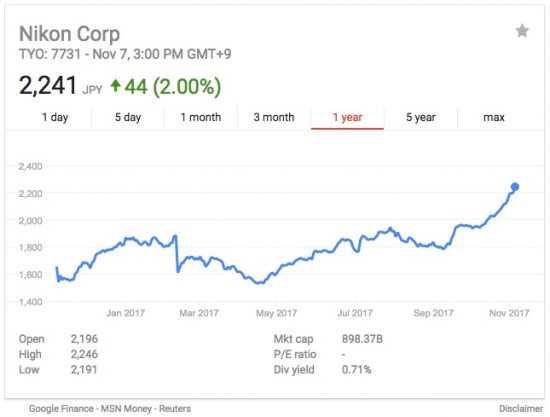

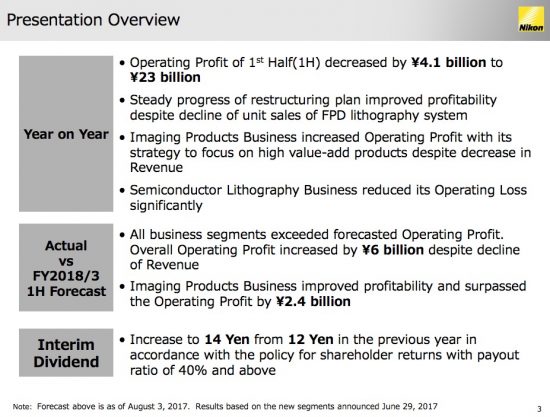

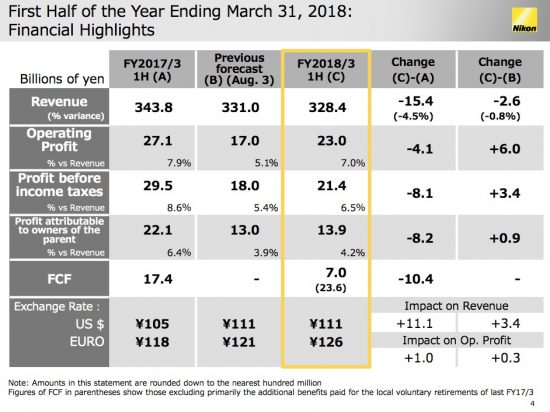

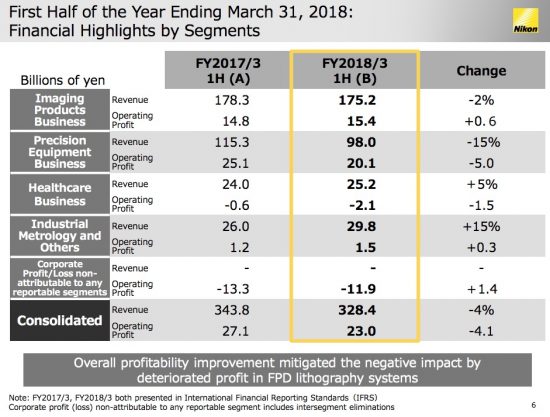

Today Nikon released their financial results for the second quarter of their financial year (ending March 2018). Here are the slides relevant to the Imaging Business (click for larger view):

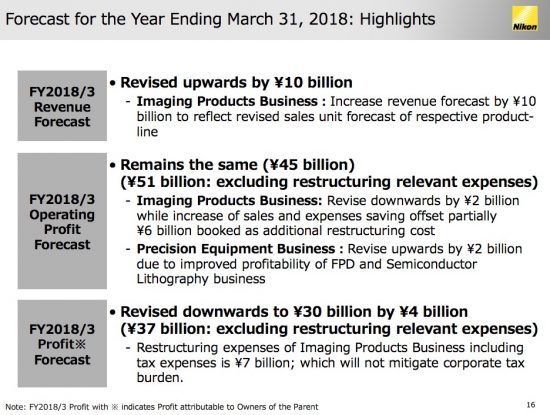

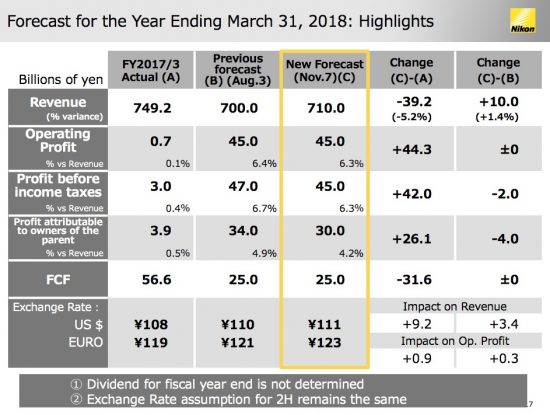

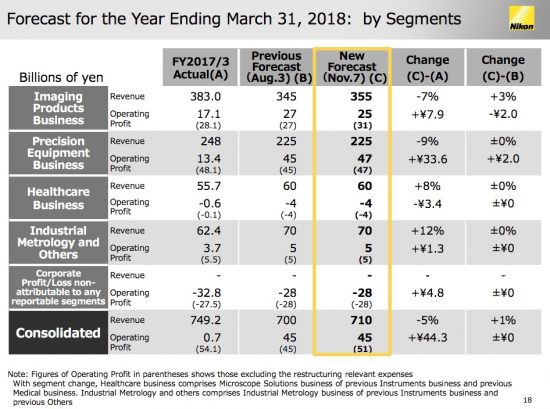

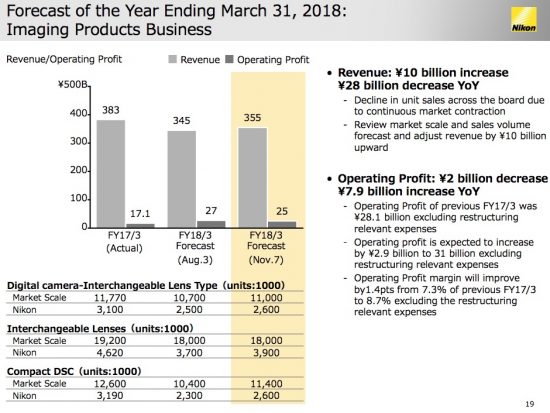

Next is the updated forecast for their financial year ending on March 31, 2018: