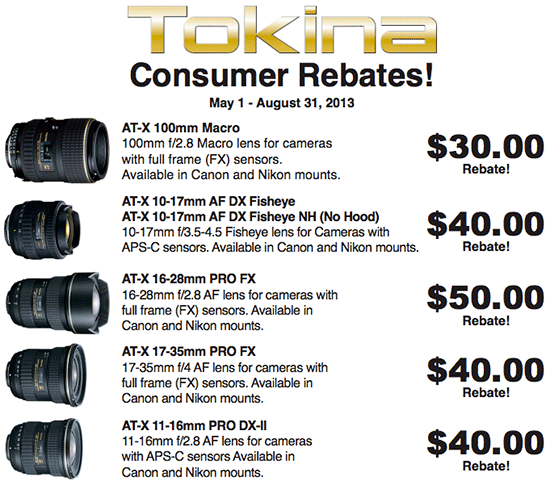

- New Tokina lens rebates and Tamron Mother’s Day savings savings.

- Coming soon: LeNs is a new interactive digital magazine for Nikon photographers.

- New Nikon Centre of Excellence is now officially open in London.

- Equinox underwater housing for Nikon D7100 is now shipping.

- Tilt-shifting with a Nikkor 50mm f/1.8D lens.