Nikon is not the only camera manufacturer that is currently having problems (see the latest rumors about Panasonic and Ricoh). The overall camera and lens markets have shrunk significantly compared to a few years ago, but the latest data shows some signs of improvement (I usually cover the monthly CIPA reports over at PhotoRumors). Here is an analysis of the latest CIPA data by Lauchlan Toal:

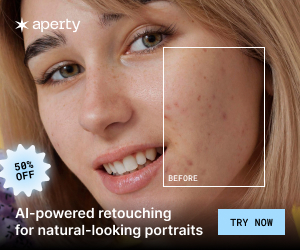

CIPA (Camera & Imaging Products Association) has recently released more statistics on worldwide camera sales, and as always this has sparked a fair bit of online discussion and speculation. Their graph of total DSC (Digital Still Camera) shipments below shows that 2017 is looking a bit better than 2016, though still not nearly as good as 2015:

Keep in mind however, that this chart encompassed both compact cameras and interchangeable lens cameras. Since the release of the camera phone, compact cameras have become something of an endangered species, so it’s no surprise that 2017 numbers don’t match 2015’s, as cellphones continue to improve their image quality with each iteration. So let’s look at the data that’s specifically for interchangeable lens cameras:

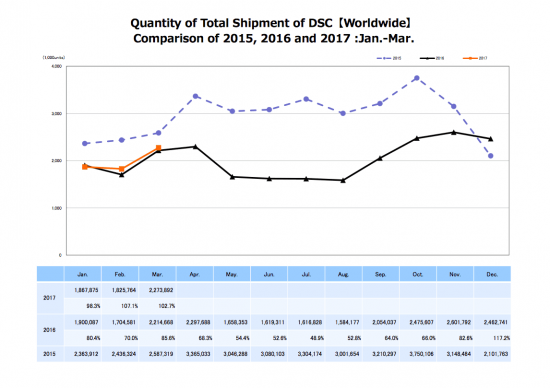

Now this is looking promising – 2017 significantly beat 2016 in February, and is on par with 2016 and beating 2015 in March. The question is, will 2017 have the slump in the summer that 2016 suffered from, or will it retain high sales like 2015?

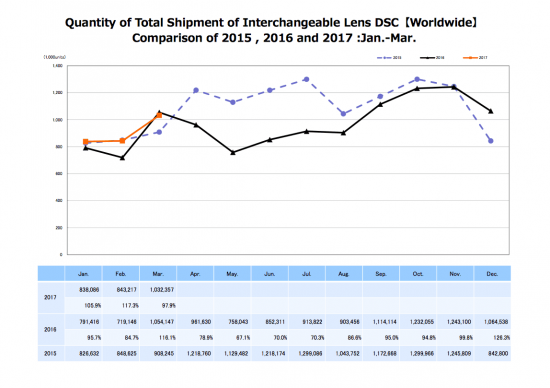

To try to determine the trend, I focused on February since it most closely matched between 2017 and 2015, and looked at the percentages of sales in different regions. Looking at both the percentage of worldwide shipping volume that each region accounts for, and the percentage of worldwide shipped goods value, we can notice some interesting trends.

Below is the data for compact cameras:

Remember, this is not total shipped units, it’s a percentage relative to the total shipped units of the month. So it’s a comparison of each country’s market share, so to speak, which is unaffected by the total number of units shipped or revenue. Europe dominates the market in terms of both volume and value, and have held at a pretty steady level for the past three years.

However, Asia has a disproportionately huge percentage of value relative to shipped units. This could indicate that Asia is the most profitable market for compacts. They may have lower volume than Europe, but their total value is approaching Europe’s, signifying higher-end products which could have better profit margins.

Another interesting aspect of this graph is that both the Americas and Japan follow a very symmetrical trend, with the Americas having lost a great deal of the market in 2016 and regaining it in 2017, and Japan doing the opposite.

With such similar market distribution in 2017 as 2015, it looks like the compact market might be able to have a better summer than it did in 2016. If we look at total figures, in February 2017 983,000 compacts were shipped, resulting in 15.23 billion Yen of revenue. Relative to 2016’s 985,000 units and 14.94 billion Yen, this is fewer units but higher revenue which is a good sign. Of course, it doesn’t come close to 2015’s 1,588,000 units and 22.08 billion Yen, but we can’t expect the compact market to recover.

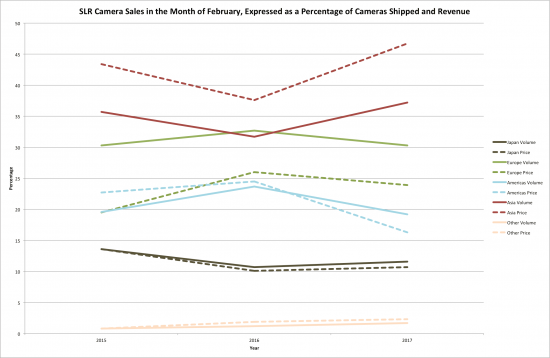

Now let’s look at DSLR cameras:

Again, we see some interesting similarities between market distribution in 2015 and 2017. Asia in particular is a surprisingly massive market – not only do they have both the highest volume and the highest revenue, they also have the highest per unit value, which means higher-end products and better profit margins. And luckily, it looks like Asia has that same symmetry around 2016 that suggests similar performance in 2017 to what we saw in 2015.

The other regions also show some similar symmetry, but it’s not as pronounced as Asia. We do see that Europe’s revenue and unit percentages are getting closer though, which means that they’re slowly edging towards more profitable products. Not dramatically, but with Europe having such a high volume it definitely matters. We’ve seen many companies, such as Nikon and Sigma, edging towards more expensive products and favouring that higher end market, so this isn’t a surprise. What does surprise me is that the Americas have done the opposite, but when we look at the mirrorless numbers this will make sense.

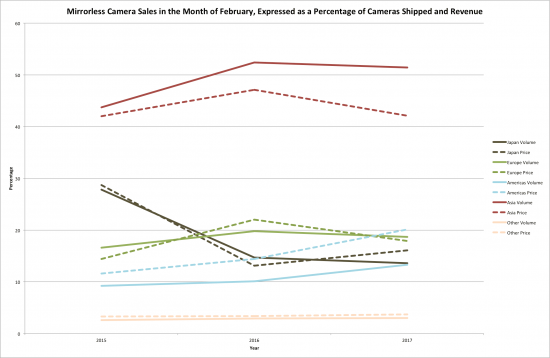

There we go – the Americas are going towards higher-end mirrorless cameras, while at the same time going towards lower-end DSLRs. This makes sense – the entry level DSLRs are rarely rivalled in price, whereas more expensive mirrorless cameras like Sony’s A7 series and the Panasonic G series are growing in popularity.

However, we don’t see as much symmetry in this graph. That said, I wouldn’t be too concerned – the mirrorless world is more turbulent, as it’s newer technology and still gaining traction. Sales of mirrorless in February of 2016 and 2017 have been around half of DSLR sales, and back in 2015 it was closer to a quarter of DSLR sales.

With that said, mirrorless is definitely a major part of overall sales, and it’s the only category that’s steadily increased both sale volume and revenue over the past three Februaries, increasing revenue by about 3 billion Yen each year.

Thanks to mirrorless’s growth, and looking at the similarities in market distribution for DSLRs in 2015 and 2017, I expect that camera sales will see much less of a dip over the summer this year than they did in 2016. Due to the declining compact market I’m not sure that overall camera sales will reach 2015 levels, but interchangeable lens cameras will likely pick up some of the slack.

One other factor that points to a successful year is the average revenue per unit. For DSLRs, the price per unit went from 49,514 Yen in 2015 to 39,961 Yen in 2016, but now it’s back up to 49,497 Yen. Mirrorless follows a similar, but less exact trend. In 2015 mirrorless’s average unit revenue was 42,729 Yen, rising to 53,887 Yen in 2016. Now it’s dropped back to 47,101 Yen. I’m guessing this makes for a good balance between sales volume and revenue per sale, but time will tell.

So keep an eye on CIPA’s data here, and we’ll see if this prediction comes true. Even if we don’t see the same revenue as 2015, 2017 should definitely do better than 2016, and if we’re lucky some of that revenue will result in more useful tools being created for us.

Lauchlan Toal is a food photographer and writer based in Nova Scotia. You can get his free guide to learning photography from his new site on creative photography.

If you have an interesting idea for a guest post, you can contact me here.