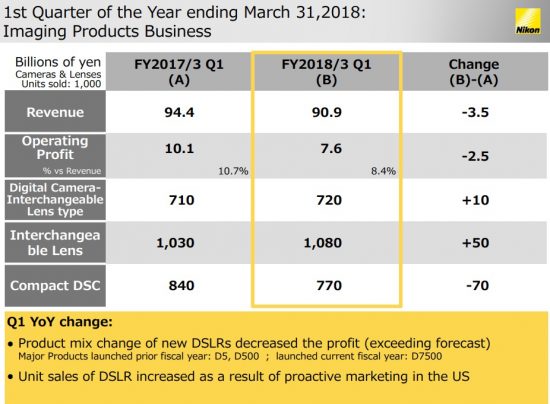

Nikon published their first quarter financial results of the year ending on March 2018:

- Operating profit of Q1 was ¥12.4 billion exceeding our forecast.

- Revenue decreased ¥5.6 billion YoY due to FPD lithography sales volume decline and a change in product mix of new DSLRs.

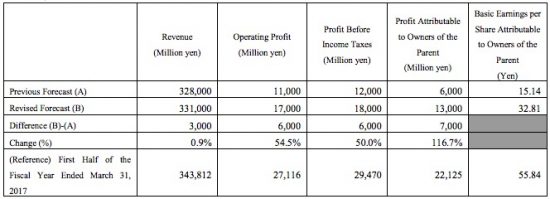

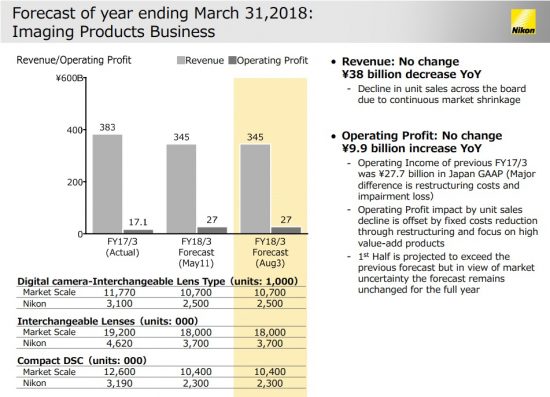

Nikon also revised their financial forecast for the fiscal year ending March 31, 2018 – the company now expect higher revenue and profit:

- Imaging Products Business: upgraded Revenue and Operating Profit by ¥5.0 billion and ¥3.0 billion respectively partly due to increase of sales volume in Q1