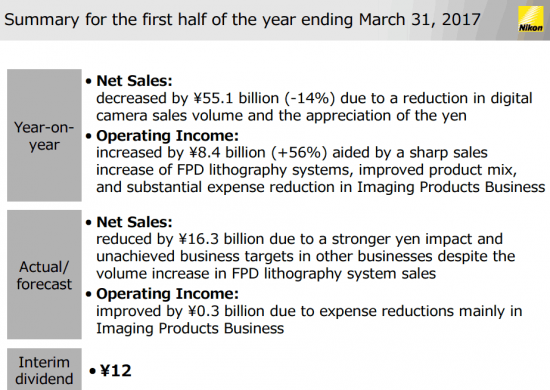

Nikon released their financial results for the first half of the year ending on September 30, 2016:

- Profits are up 54%

- Operating income is up 23.8%

- Sales are down

- Nikon also “decided to conduct a fundamental company-wide restructuring in order to enhance its ability to generate profit and create value“

Quote:

“Nikon Corp. reported that its net income attributable to owners of the parent for the first half of the year ended September 30, 2016 was 17.74 billion Japanese yen, up 53.5 percent from last year’s 11.56 billion yen. Earnings per share for the half-year period were 44.65 yen, higher than 29.08 yen last year.” (Nasdaq).

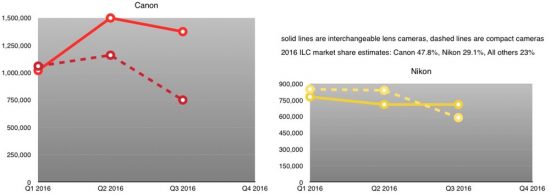

Thom Hogan posted a nice graph showing Canon versus Nikon in terms of unit volume for 2016 (the same scale is used in both charts):

“Just a reminder: Nikon is still a profitable company, and according to the numbers, healthily so. They’re not going out of business. But as I predicted, they’re getting smaller.”

Here are some unit sales numbers for the first nine months of 2016 collected and calculated by Thom:

Canon: 3.895m

Nikon: 2.2m

Other: 1.97m (Sony, Fuji, Olympus, Panasonic and Pentax)

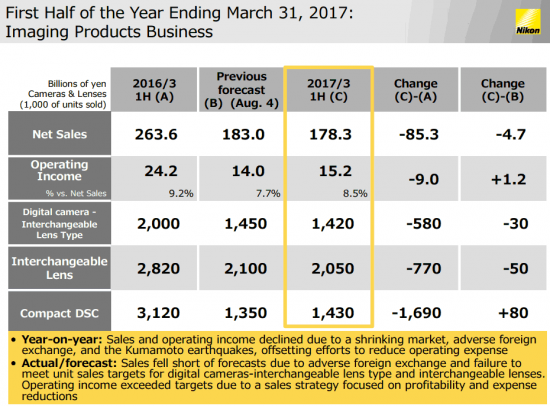

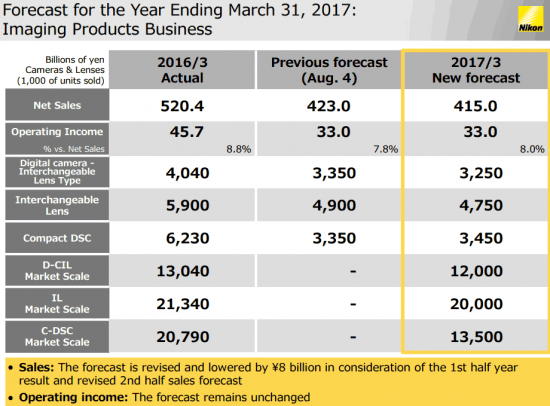

Some additional slides from Nikon’s presentation (can be found here):