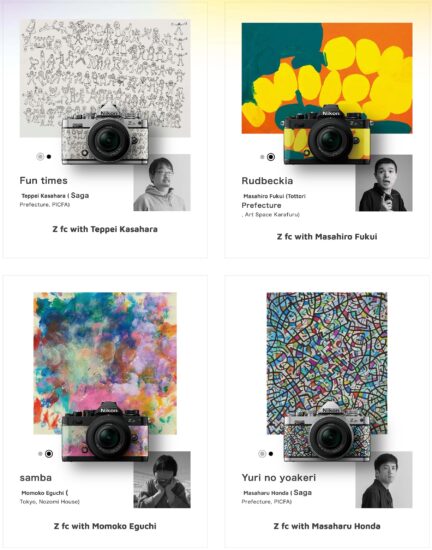

As you have probably noticed, the new Nikon Zfc HERALBONY limited edition cameras are not currently available in North America. However, we may have the option to buy them in a few months, similar to the black Nikon Zfc version.

Heralbony (check out also their online store) is a company that holds the copyright to more than 2,000 works of art by neurodiverse or disabled artists who receive royalties for their work. The agency is marketing the art in various areas. The four artists whose works were chosen by Nikon for the Zfc are Momoko Eguchi, Masaharu Honda, Teppei Kashara, and Masahiro Fukui:

Another great idea by Nikon! Bravo!

It is not possible to retrofit an existing Nikon Zfc camera with the new designs.

The new Nikon Zfc HERALBONY limited edition cameras are a Nikon store exclusive item – here are some of the Nikon websites where you can purchase them:

Read More »

![]()