Message from the CEO of Nikon, Toshikazu Umatate, on the Nikon Imaging Products Business:

The Imaging Products Business saw strong sales of the new Z8 and Zf models, which deploy leading-edge functionality from the flagship Z9 mirrorless camera, and sales volumes of interchangeable lens-type digital cameras and interchangeable lenses also increased. Going forward, we plan to continue launching products for the mid/high-end market for professionals and hobbyists, where our policy is to appeal not only to core fans but also to increase new users and especially younger users. In the market for video equipment, which is expected to expand going forward, we will provide new value by leveraging the cutting-edge technology of RED, which has widespread support in Hollywood and elsewhere for professional use, with the aim of expanding our business and acquiring new sources of revenue. (source)

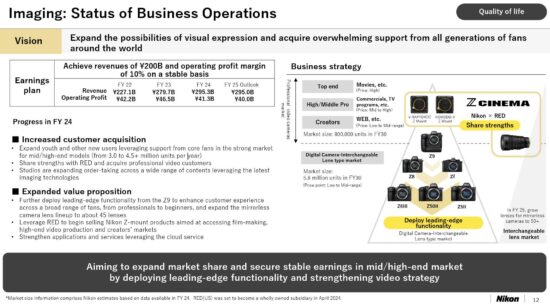

Here is the latest Nikon Imaging status of business operations (previously reported here):

Overview of Nikon’s Imaging Products Business Strategy

Nikon’s strategy for its Imaging Products Business, as detailed in the CEO’s message and the Mid-term Management Plan for fiscal year 2025 (ending March 2026), emphasizes sustainable growth through innovation in mirrorless cameras and lenses, expansion into professional video markets via the RED acquisition, and targeting a broader user base including younger demographics. The overarching vision is to “expand the possibilities of visual expression and acquire overwhelming support from all generations of fans worldwide,” while achieving stable profitability in a recovering market.

Key strategic pillars:

- Product Development and Innovation Nikon plans to continue deploying cutting-edge technology from its flagship Z9 mirrorless camera across mid- to high-end models, enhancing functionality for professionals, hobbyists, and beginners. This includes expanding the mirrorless camera body lineup and growing the Z-mount lens portfolio to over 50 lenses by the end of FY2025. Recent successes, such as strong sales of the Z8 and Zf models, underscore this approach, which incorporates leading-edge features to drive interchangeable lens-type digital camera and lens volumes.

- Market Positioning and User Expansion The focus remains on the mid/high-end segment to capture market share in a growing digital camera-interchangeable lens market (projected to reach 5.8 million units by FY2030). Nikon aims to appeal beyond core fans by attracting new users, particularly younger ones, amid an expected expansion from 3.0 million to over 4.5 million units annually by FY2030. In the burgeoning video equipment sector, the strategy leverages the 2024 acquisition of RED.com (with its Hollywood-backed professional tech) to introduce Z-mount products for filmmaking, high-end video production, and creator markets, creating synergies for content across commercials, TV, web, and studios.

- Growth Initiatives and Services Beyond hardware, Nikon is strengthening applications and cloud-based services to complement imaging products. Key efforts include sharing R&D strengths with RED to acquire professional video customers and develop next-generation technologies. This positions Nikon to tap into the professional video camera market (estimated at 800,000 units by FY2030) and expand revenue streams through new value propositions in video content creation.

- Challenges and Risk Management While profitability has improved, challenges include upfront investments delaying returns from growth drivers and potential impacts from U.S. reciprocal tariffs (estimated at ¥10 billion negative effect). Nikon is addressing these through continued R&D focus and market investments to sustain momentum in high-end areas.

Financial Targets and Outlook

For FY2025—the final year of the current Mid-term Plan—Nikon targets high earnings in Imaging to support overall profit improvements and a group ROE of 8% or higher. Specific metrics for the business include:

| Metric | Original Target | FY2025 Outlook |

|---|---|---|

| Revenue | ¥200 billion | ¥295 billion |

| Operating Profit | ¥22 billion | ¥40 billion |

| Operating Margin | 10% (stable) | >10% (strong contribution) |

This outlook reflects robust performance in professional and enthusiast mirrorless cameras/lenses, exceeding initial plans despite external pressures. Overall, the strategy balances core strengths in photography with aggressive video expansion to ensure long-term stability and growth.

Nikon Q1 financial results: revenue and profit down, sales volume up

Join the new Nikon ZR Facebook group