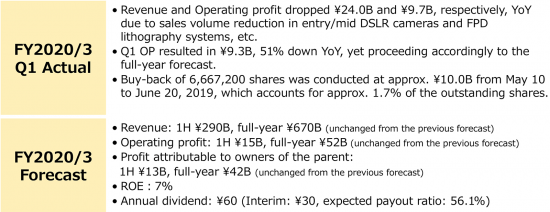

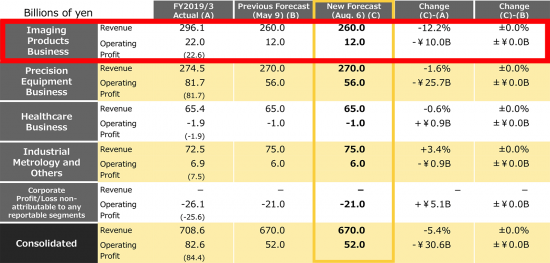

Nikon released their 1st quarter FY2020 financial results (click on screenshots for bigger view):

- In the Imaging Products Business, despite steady sales of full-frame mirrorless cameras and their interchangeable lenses, unit sales of both the digital camera-interchangeable lens type and compact digital cameras fell amidst the shrinking market. In addition, initial costs for the interchangeable lenses for mirrorless cameras also led to the decline in revenue and profits.

- Regarding the business environment for the fiscal year ending March 31, 2020, in the Imaging Products Business, both the digital camera-interchangeable lens type market and the compact digital camera market are forecast to continue to shrink.

- The unit sales of the high-end full-frame camera increased mainly in Europe and US thanks to a growth in sales of ML camera. However, revenue dropped, impacted largely by the reduced sales of entry/mid DSLR cameras in Asia including China.

- In addition to the sales impact above, the initial development cost for new ML camera lenses suppressed the profit.

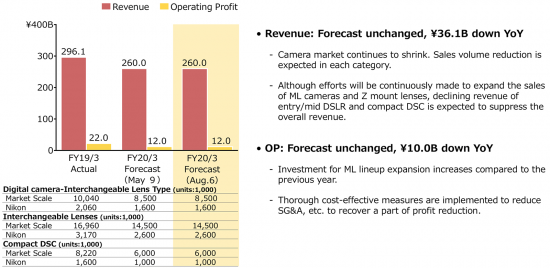

- Camera market continues to shrink. Sales volume reduction is expected in each category.

- Although efforts will be continuously made to expand the sales of ML cameras and Z mount lenses, declining revenue of entry/mid DSLR and compact DSC is expected to suppress the overall revenue.

- Investment for ML lineup expansion increases compared to the previous year.

Here is the detailed breakdown from ZoetMB:

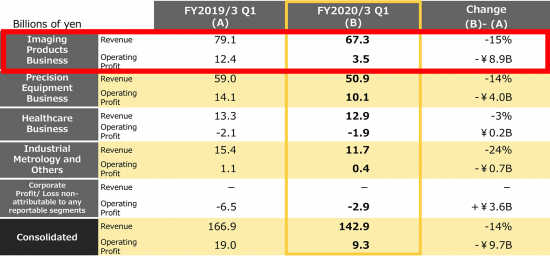

Imaging Group 1st Q FY2020 results

Compared to 1st quarter 2019:

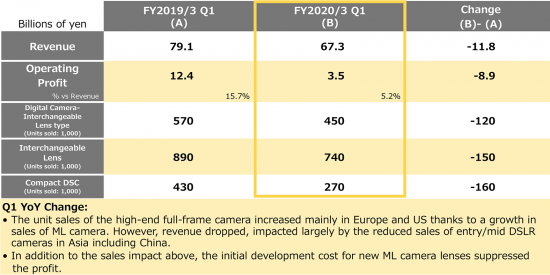

- Revenue down 14.92% (from ¥79.1 billion to ¥67.3 billion).

- Earnings down 71.77% (¥12.4 billion to ¥3.5 billion)

- Margin down 66.83% (from 15.68% to 5.2%)

- ILC Units down 21.1% (from 570,000 to 450,000)

- Compact units down 37.2% (from 430,000 to 270,000)

- Lenses down 16.9% from (890,000 to 740,000)

Share (as compared to CIPA Shipments during the same period):

- ILC: 20.3% (down from full fiscal year 2019 share of 20.5%).

- Compacts: 14.2% (down from 19.5%)

- Lenses: 20% (up from 18.7%).

Full year estimates: unchanged from 1st quarter estimate:

- Revenue: ¥260 billion,

- Earnings: ¥12 billion

- ILC Units: 1.6 million

- Compact Units: 1 million

- Lenses: 2.6 million

Based on Nikon’s estimate of the total market and their unit projection, they’re projecting full fiscal year share as follows:

- ILC: 18.8%

- Compacts: 16.7%

- Lenses: 17.9%

Nikon’s notes:

- The unit sales of the high-end full-frame camera increased mainly in Europe and US thanks to a growth in sales of ML camera. However, revenue dropped, impacted largely by the reduced sales of entry/mid DSLR cameras in Asia including China.

- In addition to the sales impact above, the initial development cost for new ML camera lenses suppressed the profit.

Nikon’s forecast for the year ending March 31, 2020 for Imaging Business:

The latest financial resutls of other camera companies can be found here.

Via Nikon