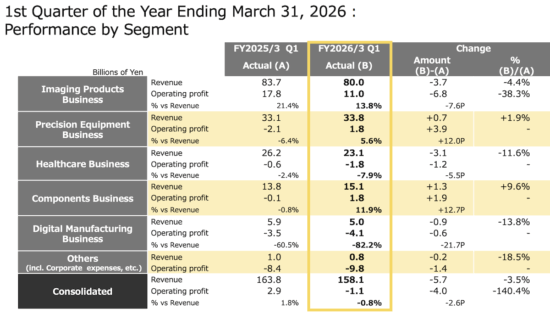

Nikon reported its Q1 financial results for the year ending March 2026:

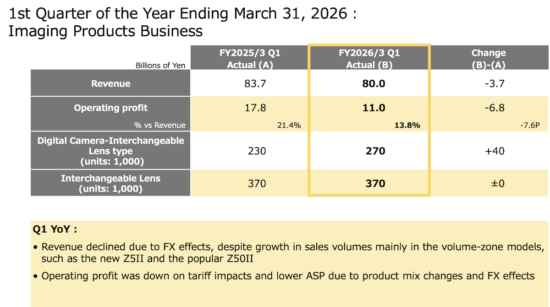

In the Imaging Products Business, sales of mirrorless cameras, centered on models such as the newly released Z5II and the Z50II, as well as interchangeable lenses remained strong. However, the business segment recorded year-on-year decreases in both revenue and profit due partly to changes in the product mix, a decline in average selling prices caused by foreign exchange effects, and the impact of tariffs.

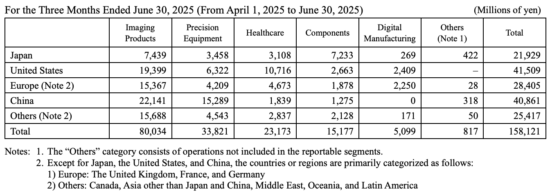

- Revenue : ¥158.1B (Down ¥5.7B YoY)

- Operating profit : -¥ 1.1B (Down ¥4.0B YoY)

- Profit attributable to owners of parent : ¥ 9.4B (Up ¥6.7B YoY)

- Revenue was down YoY. Topline growth in FPD Lithography and Components gave way to substantial hits to revenue from FX effects mainly in Imaging Products, and effects from the cutoff or suspension of grants to US academia in Healthcare.

- Operating profit was down YoY as profit growth driven by product mix improvement in FPD Lithography and effects from restructuring in Semiconductor Lithography and Industrial Solutions was overcome by FX effects and product mix changes in Imaging Products and lower revenue in Healthcare.

- Profit attributable to owners of parent was up YoY with the booking of ¥9.3B in deferred tax assets resulting from the resolution to dissolve and liquidate a consolidated subsidiary.

Details on the Imaging Business:

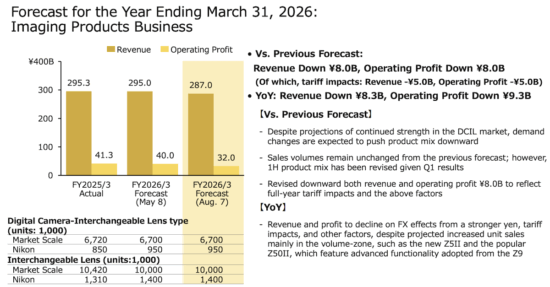

Forecast for the Imaging Business:

“Revenue and profit to decline on FX effects from a stronger yen, tariff impacts, and other factors, despite projected increased unit sales mainly in the volume-zone, such as the new Z5II and the popular Z50II, which feature advanced functionality adopted from the Z9.”

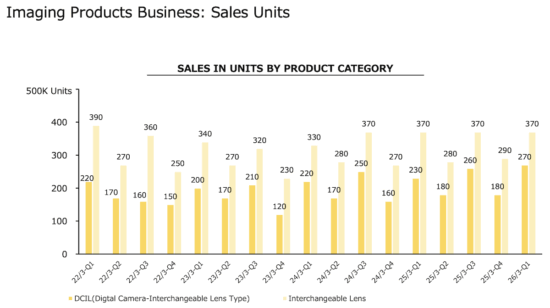

Nikon Imaging Business products sales units:

Source: Nikon