Nikon released their Q3 financial results for the year ending March 2025. Here are the overall numbers for the entire company:

- Revenue: ¥179.9B (Down ¥17.8B YoY) – Revenue declined on decreased sales in semiconductor-related businesses in the Precision Equipment and the Components.

- Operating profit: ¥ 2.3B (Down ¥18.5B YoY) – Operating profit declined on lower revenue in semiconductor-related businesses in the Precision Equipment and the Components, the disappearance of G10.5 FPD lithography system sales booked in the previous year, and one-time costs (¥2.1B) such as restructuring costs in the Industrial Solutions (former Industrial Metrology) and impairment losses on idle assets due to base restructuring.

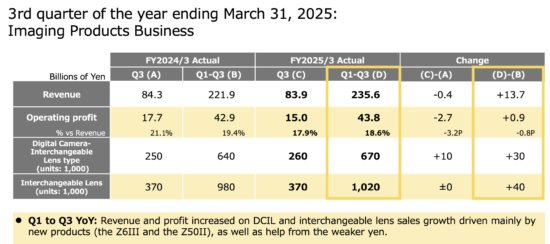

Here are the numbers for the Nikon Imagining Business:

- Q1 to Q3 YoY: Revenue and profit increased on DCIL and interchangeable lens sales growth driven mainly by new products (the Z6III and the Z50II), as well as help from the weaker yen.

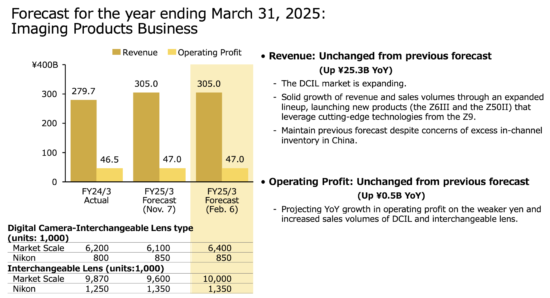

Nikon Imagining Business forecast for the year ending March 31, 2025:

- Revenue: unchanged from previous forecast (up ¥25.3B YoY)

- Operating Profit: unchanged from previous forecast (up ¥0.5B YoY)

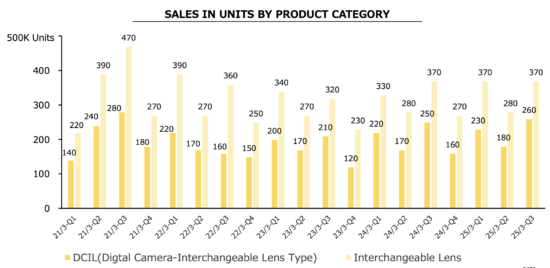

Nikon Imaging Products Business sales units:

- In the Imaging Products Business, the Group focused on expanding sales of interchangeable lenses and Z8, Zf and Z6III full-frame mirrorless cameras in addition to the newly released Z50II APS-C size mirrorless camera. Driven by such strong sales and the positive effects of the yen depreciation, the business segment recorded year-on-year increases in both revenue and profit.

- Regarding the business environment for the year ending March 31, 2025, in the Imaging Products Business, the digital camera market is projected to grow.

- During the nine months ended December 31, 2024 (from April 1, 2024 to December 31, 2024), in the Imaging Products Business, both unit sales and sales amount remained solid in the digital camera market as a whole due to strong sales of mid- to high-end products.

Update: the Q3 video call is now available here.