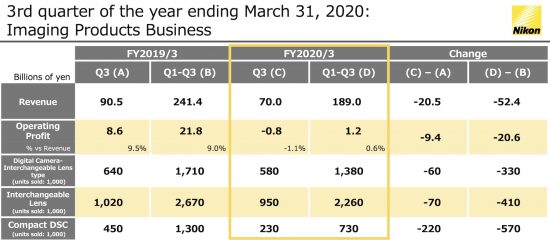

Nikon released their Q3 financial results:

Q3 YoY Change: Revenue and profit substantially decreased due to sales volume reduction, average unit price dropped caused by product mix change in DCIL, and higher initial development cost for new products, etc. ML enjoyed increase both in revenue and sales volume, thanks to Z 50 launched last November. Restructuring is underway as planned. The cost of ¥0.8B was posted to optimize functions of sales and production.

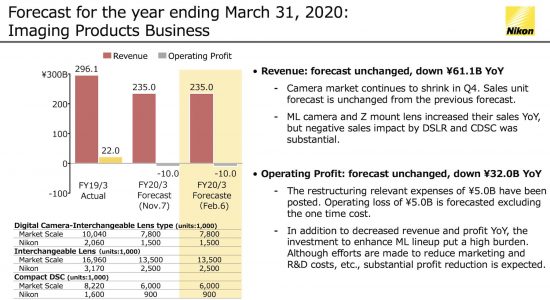

The Nikon Imaging Business forecast for the year ending March 31, 2020 remains unchanged:

Revenue: forecast unchanged, down ¥61.1B YoY:

- Camera market continues to shrink in Q4. Sales unit forecast is unchanged from the previous forecast.

- ML camera and Z mount lens increased their sales YoY, but negative sales impact by DSLR and CDSC was substantial.

Operating Profit: forecast unchanged, down ¥32.0B YoY:

- The restructuring relevant expenses of ¥5.0B have been posted. Operating loss of ¥5.0B is forecasted excluding the one time cost.

- In addition to decreased revenue and profit YoY, the investment to enhance ML lineup put a high burden. Although efforts are made to reduce marketing and R&D costs, etc., substantial profit reduction is expected.

Source: Nikon